As we near the end of the year, it is the time we recap the major news that occurred during this period. It is probably not a very good year. We started with Zika and ended with President Barrack Obama leaving the White House (bad to worse). But of course, there are some moments in 2016 that are worth rejoicing about - or at least there is ONE!

February: Zika Virus Epidemic

The World Health Organisation (WHO) declared Zika virus outbreak as a Public Health Emergency of International Concern after it started spreading like wildfire in Latin America, America, Europe and parts of Asia. It was a huge concern because pregnant mothers infected with the virus would give birth to deformed babies. It has resulted in Governments in several countries advising its citizens to delay their intention to have a child and also advise their people not to travel to affected countries.

Although the WHO declared the end of the Zika outbreak in November 2016, many countries are still closely monitoring its citizens' health condition to ensure that Zika does not result in another epidemic again.

March: Artificial Intelligence beats human in Chess

An Artificial Intelligence (AI) developed by Google defeated the best chess player in the world. While we are often defeated by the AI in mobile chess Apps, this one is different in several ways.

An Artificial Intelligence (AI) developed by Google defeated the best chess player in the world. While we are often defeated by the AI in mobile chess Apps, this one is different in several ways.

1) The chess game Go is not just another chess game. It is one of the most complicated chess game in the world, requiring intuitive, strategic and creative thinking. Most chess games are "pre-programmed" certain steps to ensure victory. But for Go, it is impossible to "pre-program" because the number of possibilities is almost endless (2.08 x 10^170 to be exact).

2) Instead of "pre-programming" all possible moves in Go into the computer, the AI is instead fed with a huge amount of gameplay to "learn" how to play Go. The AI was also made to play against itself as part of its "learning process".

We are now another step closer towards a future where robots and AI perform tasks while humans enjoy the fruits of it. Of course, the opposite is also true: a future where humans are put out of jobs by robots and AI

FYI: the creators of this AI has no idea how the AI evaluates its every move. Isn't it just magical (or scary?)

April: Panama Papers Revealed

Panama Papers, or documents of confidential financial information that were leaked to the world in April. It contains the personal financial information of rich, famous and influential people around the world, from government officials like then President of UAE Khalifa bin Zayed Al Nahyan and relatives of government officials, to sports stars like Lionel Messi and billionaires like Seydou Kane. The documents were first made known to the Journalism world in 2015, and it underwent a year of analysis before being made public in 2016.

The Panama Papers reveals the major loophole in our current tax system, allowing much rich and/or influential people to hide their money away from tax authorities (evade taxes). Although this is not illegal, it is considered by many to be immoral because these people are not paying their fair share of tax despite benefiting from their host country. Personally, I do not see it as immoral but simply a flaw in our current global tax system. Then again, can we expect change when there are people in government who are benefiting from such shady and unclear tax laws?

June: Brexit, Britain votes to leave EU

Britain held a referendum and Britons voted to leave the European Union - which they regret almost immediately after the results were out and many wanted another chance to vote to stay in EU. Many had expected the Britons to vote to remain in the EU because it was a wise choice politically and economically. As it turns out, Britons did not wish to adhere to conventional wisdom, choosing to leave EU and fund their own fiscal budget with the money that was supposed to be for the EU.

Although UK's new Prime Minister has voiced her intention to leave the EU, the whole process of leaving take around 2 years to achieve. The EU was created to push Europe, a continent with a history of wars with one another, towards unity and cooperation. Brexit has paved a way for Europe's disintegration after 20 years of effort towards integration. As nationalistic populists continue to gain a foot in European politics, government and citizens putting their own country's interest above Europe's interest, a much more divided Europe is not impossible in the next 10 years.

July: Pokemon Go Launches

With all the unpleasant event that occurred in 2016, many must be glad that this was also the year the long-awaited Pokemon Go was released! The craze lasted several months before it finally settled down, created its fair share of accidents, mishap, and misadventures, it also brought many fun moments, especially when it bonded families together to go on a Pokemon adventure and when it became a better motivator for people to walk than any other measures.

Financially, the game's popularity sent Nintendo's share rising more than double before settling at current levels of 25,000 yen per share, a 66% rise from a pre-PokemonGo price. Nintendo has also released Mario Run on Apple's App Store and is set to release even more games in 2017. Does it mean more potential upside for Nintendo's shares?

August: Brazil impeaches its President

Brazil's Senate voted to oust their President Dilma Rousseff out after months of debate over her alleged corruption charges and ineffectiveness in uplifting Brazil's economy. The President was suspected of falsifying the government's accounts. The impeachment process started in April and was only able to achieve the majority vote required to impeach President Rousseff in August. Under Brazilian laws, the country's Vice-President will take over the role of as interim President until an election is carried out and a new President elected - which is now scheduled to be in 2018.

The impeachment of President Rousseff has divided the country into 2 camps: those who support her and those who do not. A divided nation is not going to help pull Brazil's economy back from the dead. GDP has fallen for 6 consecutive quarters (worse since the Great Depression) and a Presidential scandal only made matters worse. But now that the political arena is sorted out, maybe the government can focus on what matters to the Brazilian people: a thriving economy and jobs!

September: US & China sign the Paris Global Climate Agreement

The US and China combine produces around 40% of the world's carbon emission. Their participation in being willing to cut their emission represents a huge step forward for the world to address climate change. Previously, both countries had been unwilling to join the Paris Agreement because both of them felt that it would be detrimental to their respective countries' economy if the other party did not join. The fact that both of them are now in the Agreement shows that the 2 biggest economies in the world agree and realise that climate change is real and has to be rectified; and two, are willing to communicate to achieve certain goals despite their differences.

The US and China combine produces around 40% of the world's carbon emission. Their participation in being willing to cut their emission represents a huge step forward for the world to address climate change. Previously, both countries had been unwilling to join the Paris Agreement because both of them felt that it would be detrimental to their respective countries' economy if the other party did not join. The fact that both of them are now in the Agreement shows that the 2 biggest economies in the world agree and realise that climate change is real and has to be rectified; and two, are willing to communicate to achieve certain goals despite their differences.

Under the Agreement, countries are required to cut their carbon emissions EXCEPT there is no hard rule on how much to reduce (1% drop is also allowed). But of course, countries that joined the Agreement have agreed to cut by at least 10% on average. That is a good step forward towards a better world. With countries pushing their green agenda forward, the renewable energy field is going to see a much larger boom and financing in the future! Looks like Telsa bought SolarCity fairly cheap now doesn't it?

October: Death of Thai's King

On October 13, the passing of Thailand's beloved King made headlines in most of Asia's newspaper. The Thai Prime Minister declared that Thailand would mourn for its King for a year. Without the revered King serving as an icon of unity in deeply divided Thailand, it might not be long before clashes occur in Thailand between the 2 parties in Thailand (Red-shirt United Front for Democracy Against Dictatorship and the Yellow-shirt People's Alliance for Democracy).

On October 13, the passing of Thailand's beloved King made headlines in most of Asia's newspaper. The Thai Prime Minister declared that Thailand would mourn for its King for a year. Without the revered King serving as an icon of unity in deeply divided Thailand, it might not be long before clashes occur in Thailand between the 2 parties in Thailand (Red-shirt United Front for Democracy Against Dictatorship and the Yellow-shirt People's Alliance for Democracy).

The military might use the mourning of the King's death as an excuse to delay the elections in the country. The country has been under military rule since it ousted its previous government in 2014. This creates political uncertainty and instability within the country, which does not brood well for the country's worsening economy.

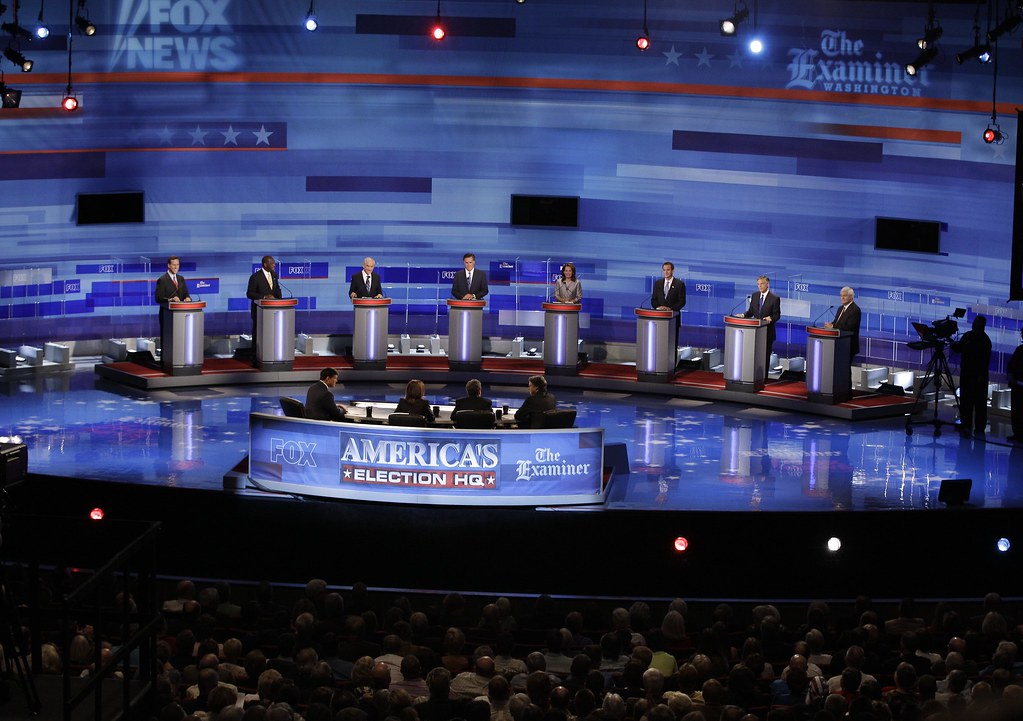

November: Donald Trump became the 45th US President

Donald J. Trump became the 45th President of the United States of America. While this came as a shock to most of the world, not all the shock was bad. While many are dumbfounded by how a man of his calibre could become the US President, others found him as a force of change in the White House. Financial markets, in particular, seemed absolutely happy that he won. The S&P500 rose 6% while the Dow rose 8.8% since after the election results were announced.

While it is good news that the financial markets are up, not all would be attributed to Donald Trump. Historically, there is evidence proving that in the year a Republican Presidential Nominee is elected, the stock markets ended in the positive territory. But the stock markets tanked in the year the Republican Nominee is inaugurated. We will just have to see if this is true in 2017.

December: 3 rate hikes next year

The US Federal Reserve Chair(wo)man Janet Yellen announced that the Fed will increase interest rates for 3 times at least next year. Last year, Janet Yellen said that we will experience 4 rate hikes in 2016. However, the Fed only raised interest rates by 4 times this year, from 0.5% to 1.375%. So far we have only seen 1 rate hike from 0.5% to 0.75%. Will we really see 4 rate hikes in 2017? Pretty sure it will be the usual "subject to the economic data of the US".

While an increase in Fed rates will increase borrowing cost for borrowers, it will also benefit savers (who are suffering from record-low interest rates). Maybe this might encourage more people to save money for rainy days (saving rates around the world is falling and indebtedness level rising).

_________________________________________________________________________________

Comment to us, or tell us, what are some of the big news that occurs in 2016. Remember to offer your opinions. If you don't put your two cents in, how can you expect to get change?

February: Zika Virus Epidemic

The World Health Organisation (WHO) declared Zika virus outbreak as a Public Health Emergency of International Concern after it started spreading like wildfire in Latin America, America, Europe and parts of Asia. It was a huge concern because pregnant mothers infected with the virus would give birth to deformed babies. It has resulted in Governments in several countries advising its citizens to delay their intention to have a child and also advise their people not to travel to affected countries.

Although the WHO declared the end of the Zika outbreak in November 2016, many countries are still closely monitoring its citizens' health condition to ensure that Zika does not result in another epidemic again.

March: Artificial Intelligence beats human in Chess

An Artificial Intelligence (AI) developed by Google defeated the best chess player in the world. While we are often defeated by the AI in mobile chess Apps, this one is different in several ways.

An Artificial Intelligence (AI) developed by Google defeated the best chess player in the world. While we are often defeated by the AI in mobile chess Apps, this one is different in several ways.1) The chess game Go is not just another chess game. It is one of the most complicated chess game in the world, requiring intuitive, strategic and creative thinking. Most chess games are "pre-programmed" certain steps to ensure victory. But for Go, it is impossible to "pre-program" because the number of possibilities is almost endless (2.08 x 10^170 to be exact).

2) Instead of "pre-programming" all possible moves in Go into the computer, the AI is instead fed with a huge amount of gameplay to "learn" how to play Go. The AI was also made to play against itself as part of its "learning process".

We are now another step closer towards a future where robots and AI perform tasks while humans enjoy the fruits of it. Of course, the opposite is also true: a future where humans are put out of jobs by robots and AI

FYI: the creators of this AI has no idea how the AI evaluates its every move. Isn't it just magical (or scary?)

April: Panama Papers Revealed

Panama Papers, or documents of confidential financial information that were leaked to the world in April. It contains the personal financial information of rich, famous and influential people around the world, from government officials like then President of UAE Khalifa bin Zayed Al Nahyan and relatives of government officials, to sports stars like Lionel Messi and billionaires like Seydou Kane. The documents were first made known to the Journalism world in 2015, and it underwent a year of analysis before being made public in 2016.

The Panama Papers reveals the major loophole in our current tax system, allowing much rich and/or influential people to hide their money away from tax authorities (evade taxes). Although this is not illegal, it is considered by many to be immoral because these people are not paying their fair share of tax despite benefiting from their host country. Personally, I do not see it as immoral but simply a flaw in our current global tax system. Then again, can we expect change when there are people in government who are benefiting from such shady and unclear tax laws?

June: Brexit, Britain votes to leave EU

Britain held a referendum and Britons voted to leave the European Union - which they regret almost immediately after the results were out and many wanted another chance to vote to stay in EU. Many had expected the Britons to vote to remain in the EU because it was a wise choice politically and economically. As it turns out, Britons did not wish to adhere to conventional wisdom, choosing to leave EU and fund their own fiscal budget with the money that was supposed to be for the EU.

Although UK's new Prime Minister has voiced her intention to leave the EU, the whole process of leaving take around 2 years to achieve. The EU was created to push Europe, a continent with a history of wars with one another, towards unity and cooperation. Brexit has paved a way for Europe's disintegration after 20 years of effort towards integration. As nationalistic populists continue to gain a foot in European politics, government and citizens putting their own country's interest above Europe's interest, a much more divided Europe is not impossible in the next 10 years.

July: Pokemon Go Launches

With all the unpleasant event that occurred in 2016, many must be glad that this was also the year the long-awaited Pokemon Go was released! The craze lasted several months before it finally settled down, created its fair share of accidents, mishap, and misadventures, it also brought many fun moments, especially when it bonded families together to go on a Pokemon adventure and when it became a better motivator for people to walk than any other measures.

Financially, the game's popularity sent Nintendo's share rising more than double before settling at current levels of 25,000 yen per share, a 66% rise from a pre-PokemonGo price. Nintendo has also released Mario Run on Apple's App Store and is set to release even more games in 2017. Does it mean more potential upside for Nintendo's shares?

August: Brazil impeaches its President

Brazil's Senate voted to oust their President Dilma Rousseff out after months of debate over her alleged corruption charges and ineffectiveness in uplifting Brazil's economy. The President was suspected of falsifying the government's accounts. The impeachment process started in April and was only able to achieve the majority vote required to impeach President Rousseff in August. Under Brazilian laws, the country's Vice-President will take over the role of as interim President until an election is carried out and a new President elected - which is now scheduled to be in 2018.

The impeachment of President Rousseff has divided the country into 2 camps: those who support her and those who do not. A divided nation is not going to help pull Brazil's economy back from the dead. GDP has fallen for 6 consecutive quarters (worse since the Great Depression) and a Presidential scandal only made matters worse. But now that the political arena is sorted out, maybe the government can focus on what matters to the Brazilian people: a thriving economy and jobs!

September: US & China sign the Paris Global Climate Agreement

The US and China combine produces around 40% of the world's carbon emission. Their participation in being willing to cut their emission represents a huge step forward for the world to address climate change. Previously, both countries had been unwilling to join the Paris Agreement because both of them felt that it would be detrimental to their respective countries' economy if the other party did not join. The fact that both of them are now in the Agreement shows that the 2 biggest economies in the world agree and realise that climate change is real and has to be rectified; and two, are willing to communicate to achieve certain goals despite their differences.

The US and China combine produces around 40% of the world's carbon emission. Their participation in being willing to cut their emission represents a huge step forward for the world to address climate change. Previously, both countries had been unwilling to join the Paris Agreement because both of them felt that it would be detrimental to their respective countries' economy if the other party did not join. The fact that both of them are now in the Agreement shows that the 2 biggest economies in the world agree and realise that climate change is real and has to be rectified; and two, are willing to communicate to achieve certain goals despite their differences.Under the Agreement, countries are required to cut their carbon emissions EXCEPT there is no hard rule on how much to reduce (1% drop is also allowed). But of course, countries that joined the Agreement have agreed to cut by at least 10% on average. That is a good step forward towards a better world. With countries pushing their green agenda forward, the renewable energy field is going to see a much larger boom and financing in the future! Looks like Telsa bought SolarCity fairly cheap now doesn't it?

October: Death of Thai's King

On October 13, the passing of Thailand's beloved King made headlines in most of Asia's newspaper. The Thai Prime Minister declared that Thailand would mourn for its King for a year. Without the revered King serving as an icon of unity in deeply divided Thailand, it might not be long before clashes occur in Thailand between the 2 parties in Thailand (Red-shirt United Front for Democracy Against Dictatorship and the Yellow-shirt People's Alliance for Democracy).

On October 13, the passing of Thailand's beloved King made headlines in most of Asia's newspaper. The Thai Prime Minister declared that Thailand would mourn for its King for a year. Without the revered King serving as an icon of unity in deeply divided Thailand, it might not be long before clashes occur in Thailand between the 2 parties in Thailand (Red-shirt United Front for Democracy Against Dictatorship and the Yellow-shirt People's Alliance for Democracy).The military might use the mourning of the King's death as an excuse to delay the elections in the country. The country has been under military rule since it ousted its previous government in 2014. This creates political uncertainty and instability within the country, which does not brood well for the country's worsening economy.

November: Donald Trump became the 45th US President

Donald J. Trump became the 45th President of the United States of America. While this came as a shock to most of the world, not all the shock was bad. While many are dumbfounded by how a man of his calibre could become the US President, others found him as a force of change in the White House. Financial markets, in particular, seemed absolutely happy that he won. The S&P500 rose 6% while the Dow rose 8.8% since after the election results were announced.

While it is good news that the financial markets are up, not all would be attributed to Donald Trump. Historically, there is evidence proving that in the year a Republican Presidential Nominee is elected, the stock markets ended in the positive territory. But the stock markets tanked in the year the Republican Nominee is inaugurated. We will just have to see if this is true in 2017.

December: 3 rate hikes next year

The US Federal Reserve Chair(wo)man Janet Yellen announced that the Fed will increase interest rates for 3 times at least next year. Last year, Janet Yellen said that we will experience 4 rate hikes in 2016. However, the Fed only raised interest rates by 4 times this year, from 0.5% to 1.375%. So far we have only seen 1 rate hike from 0.5% to 0.75%. Will we really see 4 rate hikes in 2017? Pretty sure it will be the usual "subject to the economic data of the US".

While an increase in Fed rates will increase borrowing cost for borrowers, it will also benefit savers (who are suffering from record-low interest rates). Maybe this might encourage more people to save money for rainy days (saving rates around the world is falling and indebtedness level rising).

_________________________________________________________________________________

As we come to the end of 2016, from InvestmentStab, we wish you a Happy New Year and a wonderful financial journey in the next year!

Comment to us, or tell us, what are some of the big news that occurs in 2016. Remember to offer your opinions. If you don't put your two cents in, how can you expect to get change?

Have feedback? Tell us now!

Subscribe to us or

Follow us: Investment Stab on Facebook