This post will contain a tip on how to increase your CPF returns, namely in the form of interest.

One way to earn more interest from CPF is to transfer your extra money, into your CPF Special Account.

Your Ordinary Account currently earns 2.5%, Special Account and Medisave Account earn 4% interest while your normal bank Fixed Deposit earns less than 2% annually.

Real Life Example:

My mum is 49 this year. She wanted to buy a 10-year Fixed Deposit which earns less than 3% per year. I suggested that she put her money into her CPF to earn the CPF interest.

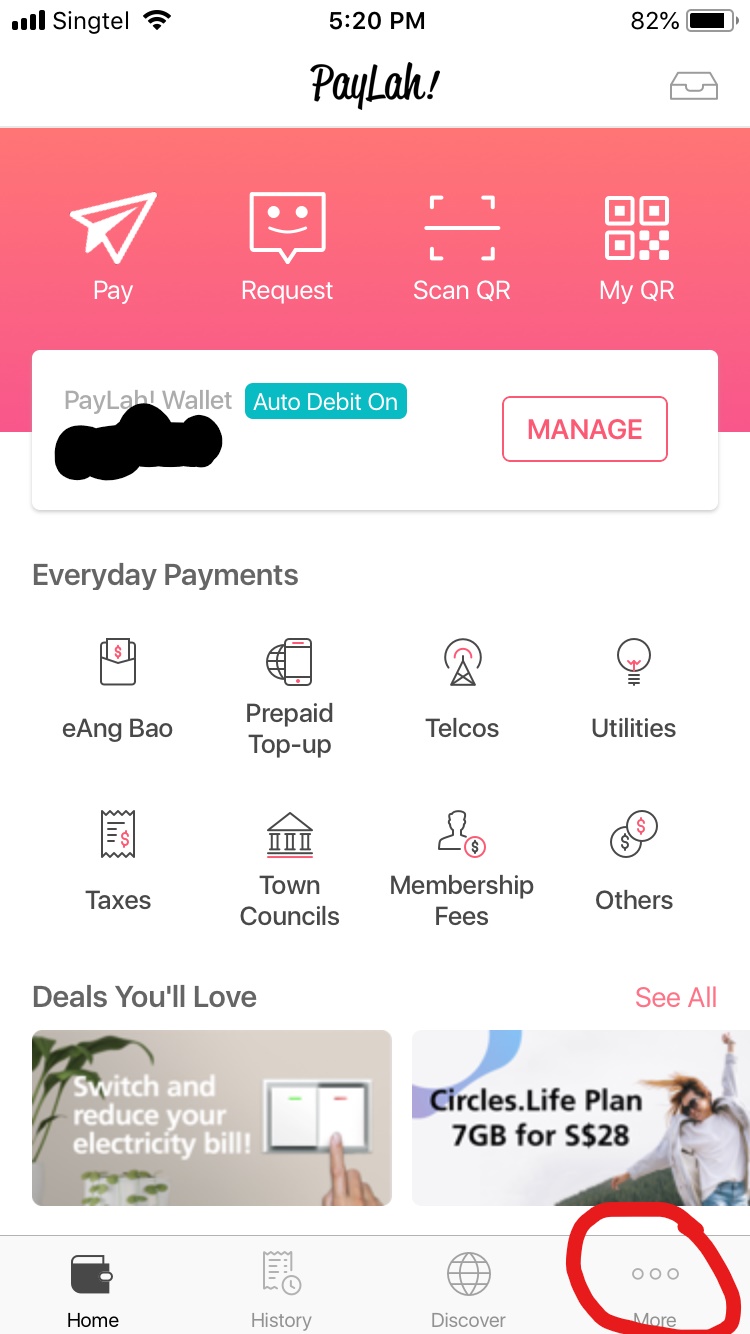

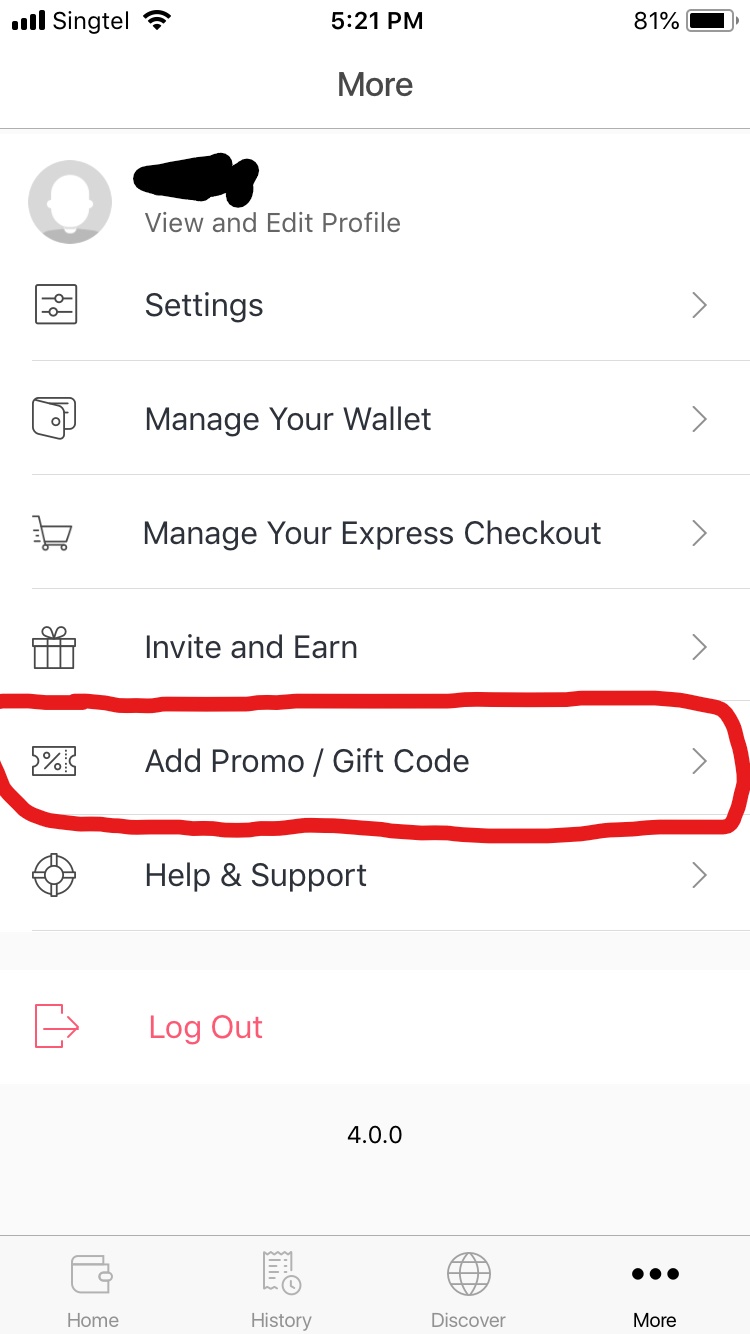

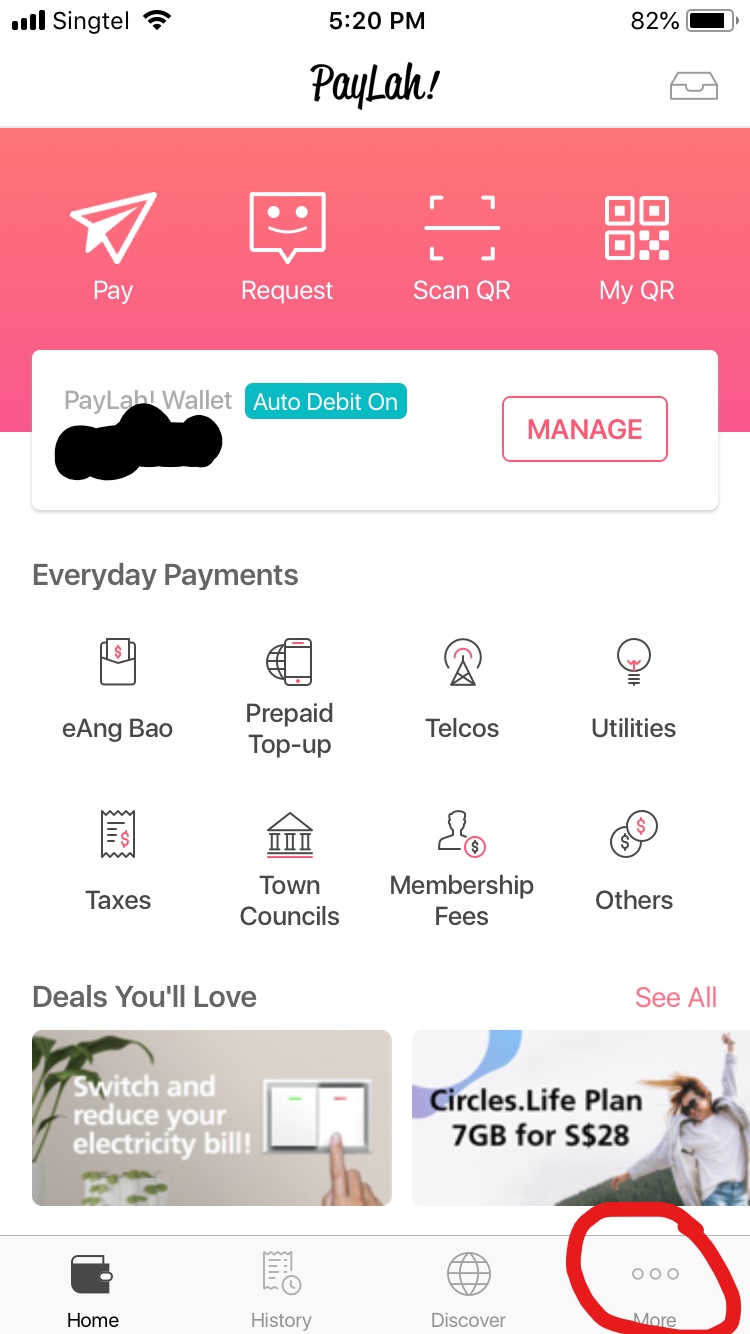

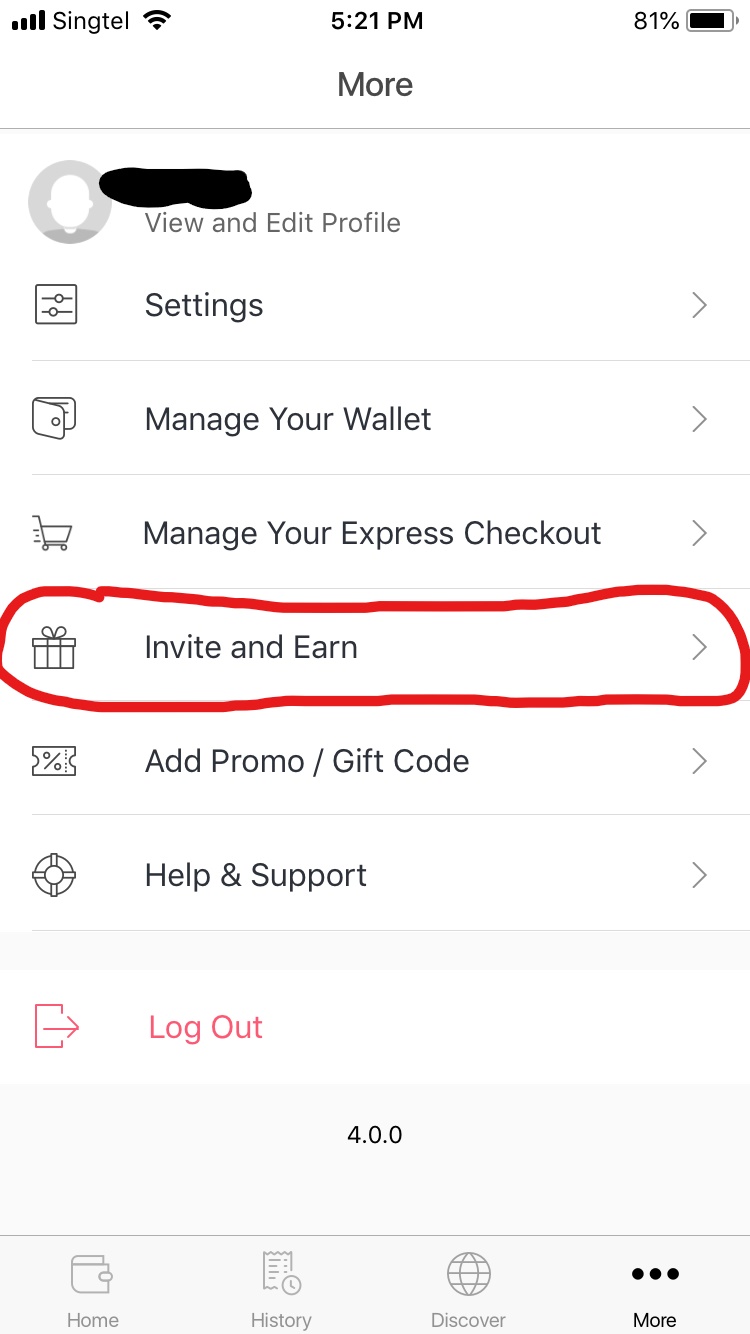

Recommended Post: Free $5 with DBS PayLah

_________________________________________________________________________________

Based on Normal Voluntary Contribution, the money will be split into the 3 accounts in the following allocation:

OA: 51.36%

SA: 21.62%

MA: 27.02%

Assuming she puts in $1,000, the allocation will be as follow:

OA: $513.60

SA: $216.20

MA: $270.2

Based on the above, my mum will get an average 3.23% interest on her $1,000 contribution.

She will not, however, get a tax deduction for the $1,000 contribution she put inside.

_________________________________________________________________________________

Based on Additional Medisave Contribution Scheme, the money will all be put into her Medisave account.

OA: 0%

SA: 0%

MA: 100%

Assuming she puts in $1,000, the allocation will be as follow:

OA: $0

SA: $0

MA: $1,000

Based on the above, my mum will get an average of 4% interest on her $1,000 contribution.

In addition, that $1,000 that she contributed into her CPF is also eligible for tax deduction.

_________________________________________________________________________________

Based on Retirement Sum Topping-Up Scheme, the money will all be put into her Special Account, or into her Retirement Account (if she is above age 55)

OA: 0%

SA: 100%

MA: 0%

Assuming she puts in $1,000, the allocation will be as follow:

OA: $0

SA: $1,000

MA: $0

Based on the above, my mum will get an average of 4% interest on her $1,000 contribution.

In addition, that $1,000 that she contributed into her CPF is also eligible for tax deduction.

_________________________________________________________________________________

She will also get to withdraw the money out when she reaches age 55.

Of course, if my mum fails to meet her minimum sum, the money that goes into her CPF will not be returned to her at the "end of the maturity" - instead, she will get it back as future monthly payouts.

But there will be other factors to consider such as how flexible you want to be able to withdraw the money.

All in all, if you wish to have a higher interest rate than Fixed Deposit, risk-free and not in need of the money being withdrawable, you can consider putting your money into your CPF, especially if you are near 55 years old - where the risk-return profile is more skewed in your favour.

Of course, if you want liquidity - the ability to withdraw the whole sum of money when you need it, this probably is not suitable for you. But, if you have way more than the required Retirement Sum, putting money into your CPF to earn the higher interest and withdraw before the Retirement Sum climbs too high sounds like a good way to make extra money.

Recommended Post: 4 Telegram ChatBots that Helps You Save Money

Remember to offer your opinions.

If you don't put your two cents in, how can you expect to get change?

Have a feedback? Tell us now!

Subscribe to us or

Follow us: InvestmentStab on Facebook

.jpg)